After a bull flag, traders may see a continuation of the upward trend if the formation was valid. However, bull flags are not always followed by an uptrend; sometimes prices may fall after a bull flag formation. In addition, bull flags can to be followed by a period of consolidation, during which prices may move sideways before resuming their upward trend. As a result, traders need to be careful not to jump into a stock just because it has formed a bull flag; instead, they should wait for confirmation of the uptrend before buying.

The bull flag trading is quite a straightforward process as long as the previous phase – spotting and drawing the formation – is done properly. As outlined earlier, the bull flag gives a shape and formation to the uptrend and it helps traders to determine entry and limit levels, which is exactly what we are going to do now. We use the same GBP/USD daily chart to share simple tips on trading bullish flags. The breakout occurs once the buyers reassume control of the price action after a temporary pause in the uptrend.

Trading with the Market strategy

When Temitope is not writing, he takes his time to learn new things and also loves to visit new places. They’re two of the most common crypto flags, but knowing how to use them properly is important. Register below to discover the top 5 mistakes losing traders make, how to avoid them, and more. Let’s now get straight into the buying rules for the best Flag pattern strategy.

A bull flag pattern is characterized by a flag of consolidation that is horizontal or sloping downward and is followed by a substantial increase in the upward direction or the breakout. In volatile cryptocurrency market conditions, traders use crypto trading strategies like swing trading and a bull flag pattern for trading during a strong trending market or after a breakout. A bull flag pattern forms when there is a steep rise in the price of the underlying asset, followed by a period of consolidation in a narrow trading range. The trading range appears rectangular and may establish parallel lines of support and resistance.

Bull Flag vs Bear Flag – Key Differences

This objective is the polar opposite of what bearish flags suggest. A bull flag chart pattern is a continuation pattern that occurs in a strong uptrend. It signals that the prevailing vertical trend may be in the process of extending its range. Bull flags are the opposite of bear flags, which form amid a concerted downtrend.

They usually provide entry signals that allow traders to enter an uptrend. The pattern is characterized by an initial strong upward move, followed by a short consolidation period and the bullish trend’s continuation. There are many interesting trading concepts and patterns that crypto traders find useful; two are the bull flag and the bear flag.

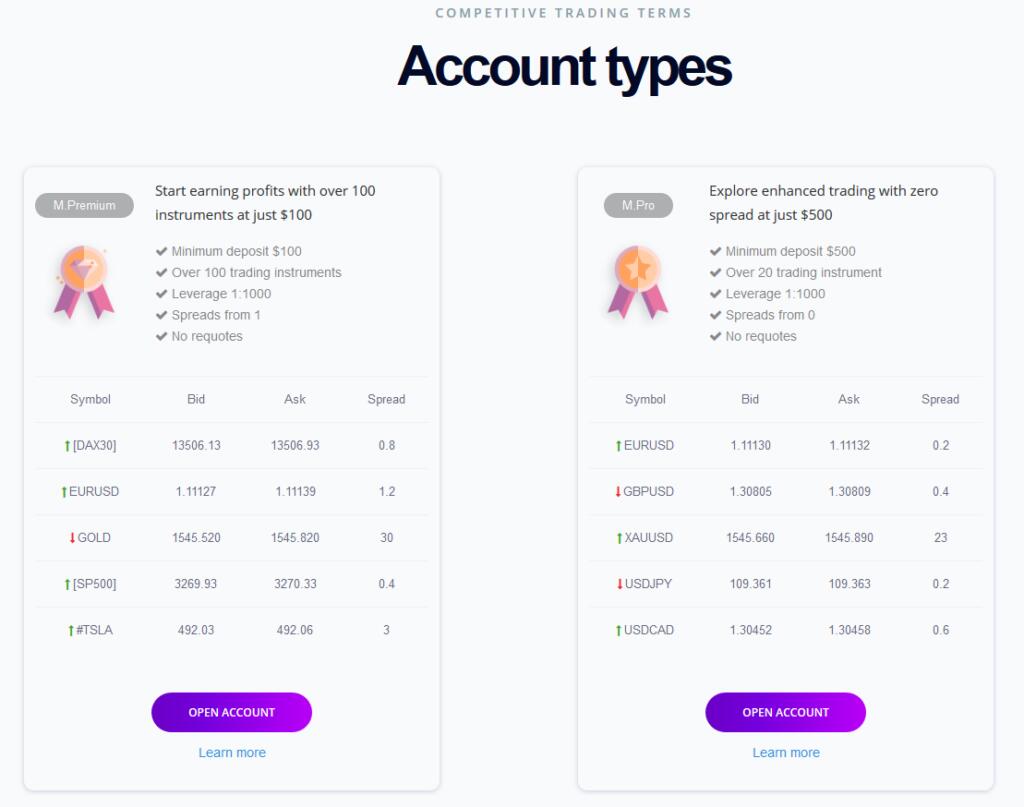

Futures and options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. This website is neither a solicitation nor an offer to Buy/Sell futures or options.

On the contrary, technical analysis disregards the EMH and is only interested in the price and volume behavior of the market as a basis for price prediction. A technical analysis pattern called the bull flag is a recognized price pattern and is thought to indicate that a price increase is about to occur. A bull flag pattern resembles a flag on a pole and appears when a cryptocurrency is experiencing a significant price rise. Flag patterns are considered to be among the most reliable continuation patterns that traders use because they generate a setup for entering an existing trend that is ready to continue. Flag formations are all quite similar when they appear and tend to also show up in similar situations in an existing trend.

Ascending Triangle Chart Pattern: Definition, How to Trade it

If you enter on the break of the highs, it could be a false breakout. But, if it’s a real breakout, it’s the best possible price you can get. Whatever the case is, this is a sign of strength and the market could breakout higher. The type of price action that exhibits in the pullback bull flag formation is what separates the Flag Pattern from a normal pullback. Eventually, the price peaks and forms an orderly pullback where the highs and lows are literally parallel to each other, forming a tilted rectangle. Harness the market intelligence you need to build your trading strategies.

- In volatile cryptocurrency market conditions, traders use crypto trading strategies like swing trading and a bull flag pattern for trading during a strong trending market or after a breakout.

- Bull flags typically begin to surface in conjunction with a new market rally.

- You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- Without a sharp move, the reliability of the formation becomes questionable and trading could carry added risk.

- While the flag is not a perfect rectangle, what is more important is the basic premise behind the overall pattern.

Bullish and bearish flags are both strong continuation flag patterns. A bear flag is the complete opposite of a bullish one, it means a trend line reversal at the top. The break of the flag, which occurs in the third stage of the bull flag pattern, offers the optimal entry signal. The previous swing high will serve as the initial profit objective for the bullish flag pattern, and the consolidation structure might serve as the stop-loss level. Therefore, we are looking to identify an uptrend – the series of the higher highs and higher lows. The second step in spotting the bull flag pattern is monitoring the shape of the correction.

A trading target from the breakout is often derived by measuring the height of the preceding trend (flagpole) and projecting a proportionate distance from the breakout level. The above content provided and paid for by Public and is for general informational purposes only. It is not intended to constitute investment advice or any other kind of professional advice and should not be relied upon as such.

The point of the strategy is to identify the optimal entry point with the help of a pending buy order. You can open a long position when, after a downward consolidation, the candle closes above the upper limit of the trend. After the retracement, we are waiting for the breakout of the upper border of the formed rectangle.

This makes sense since in an uptrend, profit taking will result in lower prices as traders sell stock. In a downtrend, profit taking will result in higher prices as traders buy stock to cover short positions. Price reaches a level where profit-taking begins and starts to move lower. Price moves lower in a zigzag manner within a downward sloping channel. Traders refer to the price action within the channel as a consolidation.

- Once the price breaks out of the consolidation phase, it signals that the uptrend is likely to continue.

- The resistance levels remain as high as the flag pole and create a horizontal line across the top.

- Although flags are very simple classical chart patterns, they provide an extremely accurate prediction of the next price movement.

- Bull flags are usually formed in strong uptrends and are considered continuation patterns.

- A bear flag is the complete opposite of a bullish one, it means a trend line reversal at the top.

In addition, it is easy to confuse it with other technical analysis patterns. Therefore, it is recommended to use candlestick analysis in combination with this pattern. To summarize the patterns in general, they indicate a continuation of the prior trend, with the flag representing a pause or consolidation before the trend resumes. In an uptrend a bull flag will highlight a slow consolidation lower after an aggressive move higher. This suggests more buying enthusiasm on the move up than on the move down and alludes to the momentum as remaining positive for the security in question.

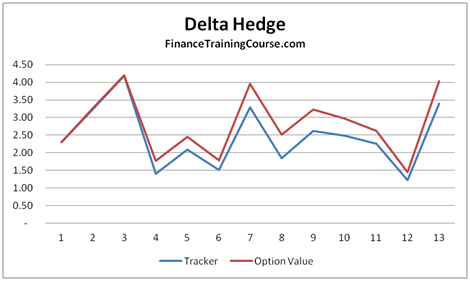

First, we measure the distance the price traveled from the starting point of the bullish flag pattern to the flag and project that move to the upside. Not only that the bullish flag pattern is a very simple technical indicator, but it can lead to moves that are of the same magnitude as the flag pole movement. In the next section, you’ll learn how to trade bullish flag pattern and how one should trade the best https://trading-market.org/ flag pattern strat egy. This could be as a bull flag appearing in a market with accelerating interest or a bear flag forming in a trend with weakening momentum. Volume is also crucial, as strong moves usually accompany a breakout. It is not uncommon for traders to confuse flag patterns with pennants, another type of continuation pattern that suggests the trend will likely continue after consolidation.

What is a bull flag formation?

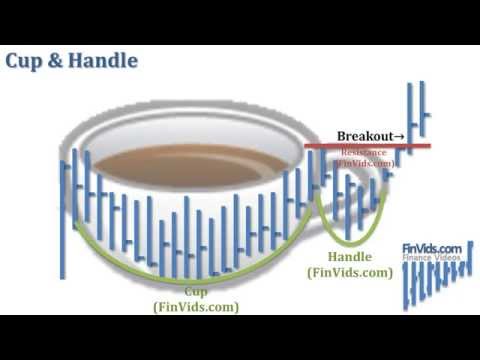

The bullish flag pattern gets its name because it resembles a flag on a flagpole. A steep vertical rise in price is followed by a period when the price remains bounded between 2 fairly close, roughly horizontal lines. The pole represents the steep rise in price, and the flag represents the area between the 2 lines.

The resistance levels remain as high as the flag pole and create a horizontal line across the top. The bottom support levels may continue to ascend creating a triangle (sometimes called a ‘pennant’). We recommend all the time to play with the charts and zoom out so you can better identify the bullish flag pattern.

What happens when a bull flag forms?

A bullish flag consists of the flagpole and a flag. As such, it resembles a flag on a pole. It's constituted after the price action trades in a continuous uptrend, making the higher highs and higher lows.

In this case, the consolidation takes a bit more time than usual, but it is not an aggressive correction lower. The price action actually moves more in a sideways fashion, but still with an overall bias lower, as the buyers consolidate their power. Finally, there is a break to the upside, which takes the price action aggressively higher. Overall, both are bullish patterns that facilitate an extension of the uptrend. A bull flag is a candlestick pattern that allows traders to participate in a bullish market.

This sounds very simple, but it takes a trained eye to really see the quality of the bull flag. As a breakout strategy, you want to make sure that you respect your stops and analyze the price and volume well. Similarly, you want to make sure you are trading off of the correct time frame for the context of the move. Lastly, be sure to analyze volume to determine the reliability of your bull flags. If volume expansion returns well on a stock, it should lead to higher prices. This is somewhat discretionary, but you don’t want to see a weak breakout on low volume.

Trading Strategies For Advanced Micro Devices Stock Before And … – Benzinga

Trading Strategies For Advanced Micro Devices Stock Before And ….

Posted: Tue, 02 May 2023 07:00:00 GMT [source]

The essential characteristic of a bullish flag pattern is a short downward consolidation, after which the instrument shows a sharp rise. Bull and bear flags are popular price patterns recognised in technical analysis, which traders often use to identify trend continuations. The “bull flag” or “bullish flag pattern” is a powerful indicator for trading uptrends or topside market breakouts.

How reliable is a bull flag pattern?

Among the various technical chart patterns in their toolboxes lies the bull flag chart pattern, which is also one of the most common. This pattern is reliable, consistent, and common. It is found anywhere from the daily chart to the 5-minute chart, and as such, it is a pattern that all traders should be aware of.